Our Model

Cimarron brings venture capital and business-building talent to underserved regions.

Cimarron Capital Partners is a pioneer in strategic fund investing

with over twenty years of experience designing and managing venture capital and private equity programs for regional economies. We utilize private capital to attract high-performing business builders whose time, talents, energy and capital help grow local entrepreneurial ecosystems. Our investments are designed to produce both strategic impact and financial return.

Cimarron's approach to investing

helps regional economic development efforts:

Attract Business Builders

By investing in venture capital and private equity funds, a region captures the time and attention of these professional business builders

Diversify Economies

The talents, energy, and capital of fund managers can catalyze growth in emerging sectors

Promote Innovation

Fund managers seek out and support the most innovative segments of an economy

Build Entrepreneurial Ecosystems

Along with investments, activities such as trainings, forums, and angel networks help grow the local ecosystem

Many regions in the U.S. are underserved by the national venture capital network. This presents a challenge to the many family offices, foundations, corporations and economic developers who hope to match the research and talents in their communities with smart capital.

Cimarron takes on this issue through the use of a fund of funds operated so as to build more connections between local entrepreneurs and the national venture capital community. We back fund managers who have a history of producing solid returns, who demonstrate an appetite for deals that fit with opportunities in the target region, and who commit to plans for becoming visible and accessible to local entrepreneurs, in effect to be part of the region’s investor and entrepreneurial community. We negotiate time-and-attention clauses, closely monitor the funds throughout the investment, and leverage the fund investments to serve our clients in other activities of ecosystem development.

A regional fund of funds can help local companies connect with the national network of venture capital funds.

The benefits accrue with time: more elements of the national venture capital network grow to know the region; local companies have more investors to talk to about their needs; local accelerators, angels, and venture investors connect with a broader network of potential co-investors and specialized knowledge; and the fund of fund’s investors contribute to the growth of the local economy while also putting their capital to work for a profit.

Strategic Impact

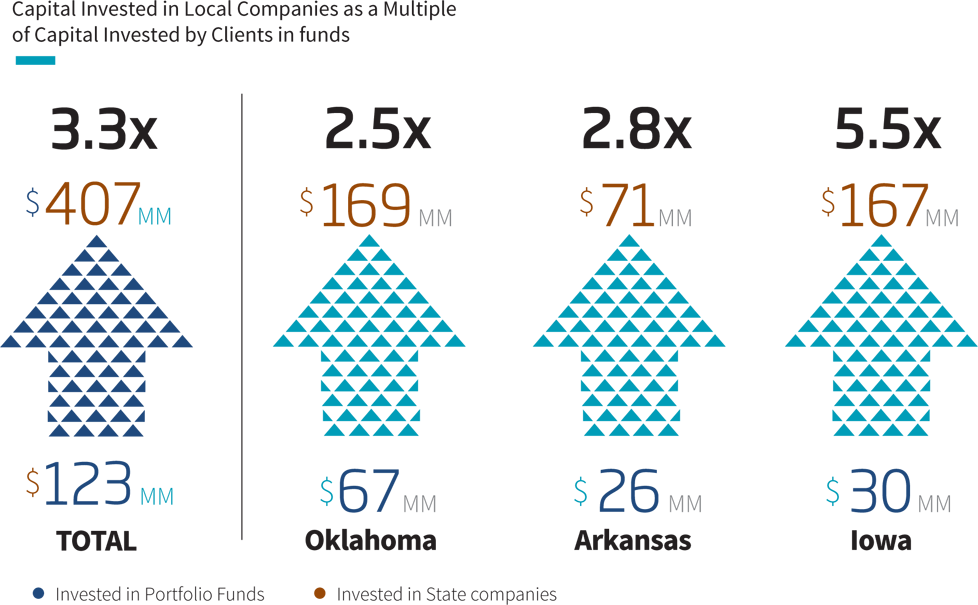

Cimarron has designed and built funds of funds for the Oklahoma Capital Investment Board, the Arkansas Development Finance Authority, and the Iowa Capital Investment Corporation. We have also advised several states as well as the countries of Mexico and Colombia regarding the development of fund of funds programs. The $123 million invested by our three U.S. clients in venture capital and private equity funds, selected and monitored by Cimarron, has attracted $407 million to in-state companies, a 3.3 to 1 ratio. These local investments have generated over $3.4 billion in aggregate economic output to date, in addition to new jobs, payroll, and tax revenue.1

1. Economic impacts represent all funds and are independently reviewed by Applied Economics, Phoenix AZ.

Cimarron's investments have generated a total of $3.4 billion in local economic impact.

Financial Impact

Cimarron has achieved positive Financial Returns

as well as Strategic Impact.

In addition to achieving a substantial strategic impact, Cimarron always seeks to generate a market rate of return for its investors. Toward that end, Cimarron targets seasoned national fund managers from outside the targeted region who bring their talent to local economies. We invest in funds with the following characteristics:

- Competitive footprint and ability to invest from a healthy pipeline of deals

- Strong reputation in the venture capital/private equity industry and ability to successfully syndicate deals as needed

- History of working productively and respectfully with entrepreneurs

- Sufficient experience and outstanding performance in the current investment strategy

- Willingness to be part of a local ecosystem and implement a credible plan to source in the targeted geography

The service of the firm to its clients has been specific to the strategic mandates of these clients and market conditions of the time. Past performance is no guarantee of future results for current or future clients.